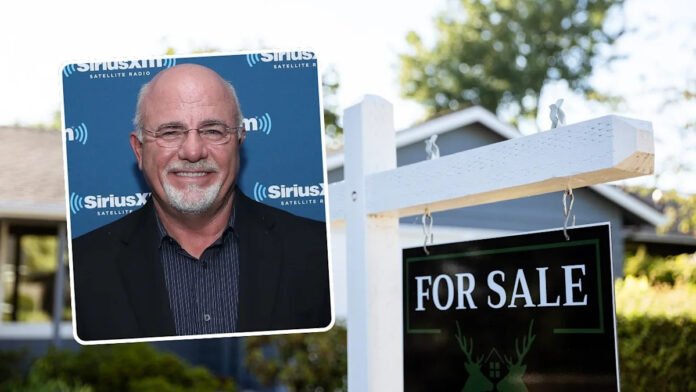

On his namesake radio show, Dave Ramsey addressed the growing debate about renting vs. owning while speaking to a 58-year-old Chicago homeowner who’s considering downsizing and selling her paid-off $350,000 house.

One factor in her decision was her well-established emergency reserve and $1 million in 401(k), keeping her sufficiently funded for her upcoming retirement.

While renting over buying might seem safe and financially sound to some, Ramsey told her she could become a “victim of the real estate market” if she went through with it—and other experts agree.

What Dave Ramsey advises retirees—and how renters compare today

“Renting for 30 years means you are a victim of the real estate market instead of riding the wave,” Ramsey explained. “Think about what rents have done in the last 30 years, and think about what they’re going to do during the 30 years that we’re talking.”

Steve Sexton, CEO of Sexton Advisory Group, agrees with Ramsey that renting indefinitely can become a financial trap, especially for someone with a strong income and savings.

He notes that rents have climbed dramatically in recent years, and for many people nearing retirement, that instability can disrupt a well-planned budget.

“If you’re financially disciplined and understand your monthly expenses, locking in a fixed mortgage can give you long-term predictability while turning your monthly housing cost into equity, and not just an expense,” he adds.

Ramsey offered another option that could make financial sense—especially for older buyers and sellers: downsizing to a condo.

Downsizing can be a sound move for older homeowners and could save them thousands of dollars, especially when they retire and transition to a fixed income.

The listener explained that she didn’t want to deal with the hassles of a big house anymore, as her children had moved and she was tired.

With that in mind, it’s clear to see why she considered renting: When you rent, repairs and issues are taken care of for you, which alleviates many of the headaches and costs of homeownership.

But to Ramsey’s point, renting might not be more financially prudent than downsizing to a smaller home, given Chicago’s high transaction costs.

According to Realtor.com® data, the median rent for a one- to two-bedroom in Chicago was $1,793 in May, a welcome 1.5% year-over-year decline but an eye-popping 15.1% six-year change.

A Realtor.com report also noted that 25% tariffs on steel and aluminum could increase rent prices, “as developers may slow construction or pass higher expenses on to tenants.”

Meanwhile, the median home list price in Chicago in June was $350,000, with the median home list price per square foot at $276, according to Realtor.com. This price tag is below the national median price of $440,950 for homes in June.

Bobbi Rebell, certified financial planner and personal finance expert at CardRates.com, says this situation reveals that not all homeownership is the same.

“She can get the benefits she wants from renting by buying a condo: low hands-on maintenance, for example, by owning a lower-maintenance home. Specifically, by buying a new condo that has services built in through a homeowners association, she can get the easier and less stressful lifestyle she wants,” she adds.

Rebell notes that the challenge with renting, especially as you move into retirement years, is that it can be risky financially because you are at the landlord’s whim.

“Not only could a landlord raise your rent, they could simply decide they don’t want to rent out the unit anymore and ask you to leave. Even in areas where there are tenant protection laws, being in conflict with your landlord is not a hassle or stress you want to have when what you really want is peace and relaxation, and an easier, lower-maintenance lifestyle,” Rebell explains.

Stacy Brown, senior director of training at Real Property Management, says that for individuals who are financially disciplined and have clarity around their monthly budget, the predictability of a fixed-rate mortgage (even with occasional maintenance costs) might prove more manageable in the long run than the uncertainty of annual rent increases.

“Moreover, ownership offers a hedge against inflation and the opportunity to build or preserve equity,” she added.

Why a condo could be the best of both worlds in Chicago

That’s why Ramsey offered the caller the alternative. Moving to a condo could be the best of both worlds, as it would represent a downsize, while not wasting money on rent.

He pointed out that at her home equity level, which is around $350,000, she could afford a condo with lower costs, less maintenance, and fewer unknowns.

The median condo price in Chicago is around $350,000 in 2025, according to Realtor.com.

While a condo is priced similarly to her current home, it offers perks like HOA-managed maintenance and predictable costs—benefits that can be especially appealing to retirees.

Brown also notes that in Chicago, where property taxes, snow removal, and maintenance can be daunting, condo living can offer the perfect hybrid model.

“The buyer gains ownership and equity preservation, but with shared responsibilities and often lower total maintenance costs,” she says. For someone with $350,000 in home equity, it’s entirely feasible to purchase a modest, well-managed condo outright or, with a small mortgage, leaving retirement savings untouched or minimally affected.

Rebell adds that a condo with new appliances and finishes is unlikely to need maintenance and is a great situation for someone looking to reduce their hands-on involvement with their home.

“If the condo has an HOA, that can serve as a way to avoid direct day-to-day involvement in maintaining the grounds or any building-wide maintenance and keep in step with an easier and less stressful lifestyle,” she adds.

This option can make sense for individuals in this caller’s situation as it enables them to own without overextending, and maintain the ability to free up some of that 401(k).

Sexton notes that another key point in Ramsey’s advice was the focus on buying within your means.

“I always tell my clients that just because they can afford more doesn’t mean they should buy higher. Later in life, you want to maintain access to your retirement accounts and not overleverage. Buying a home should strengthen your financial position, not strain it. If you can purchase something manageable while keeping your 401(k) intact, you’re setting yourself up for a more secure and flexible retirement,” he adds.