Nothing goes in a straight line on Wall Street, though investors often like to extrapolate current trends far into the future. These two facts can open up investment opportunities in growing companies that are facing problems likely to be temporary. This is why investors with $1,000 to invest might want to consider these two growth stocks that have fallen out of favor on Wall Street. One was recently bought by Berkshire Hathaway.

1. Pool Corp. is a Warren Buffett pick

Pool Corp. (POOL 0.02%) sells pool supplies, from chemicals and other maintenance items to the things needed to build new pools. Maintenance items are the biggest piece of its business, representing around two-thirds of revenue. That is the important dynamic because it means that Pool’s business is inherently tilted toward growth, which is likely why Warren Buffett and his team bought the stock.

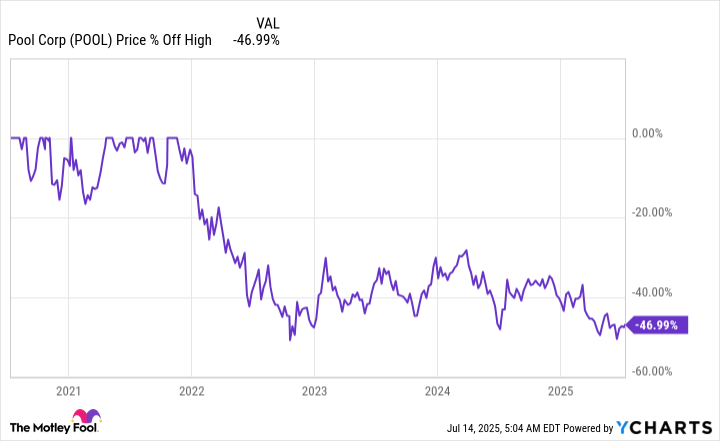

Buffett tends to buy well-run companies when they are attractively valued. Pool’s stock has fallen roughly 45% from its 2021 peak when there was a pool building boom. That coronavirus pandemic-driven building boom fizzled out after the world got used to living with COVID and interest rates rose. But every single pool that got built, and any that has ever been built, needs to be maintained until it is torn out. So every new pool increases the number of potential customers for Pool’s business. And that means that Buffett can hold for the long term, confident that Pool will continue to grow its business.

The problem that investors need to come to terms with is that the construction side of Pool’s business can be lumpy. That’s why Wall Street is downbeat on the retailer today. Investors are overlooking the inherent growth bias that Buffett is eyeing, and you should, too. A $1,000 investment will buy around three shares.

Image source: Getty Images.

2. Hershey is controlling what it can

Hershey (HSY 0.01%) is an iconic consumer staples stock with a focus on confections and other snacks. Although it has been expanding its business to include things like popcorn and pretzels, one of the company’s most important products remains chocolate. It is an affordable luxury that consumers love, and Hershey’s sales seem to just keep moving higher and higher over time. In 2025 the company believes the top line will increase around 2% or so.

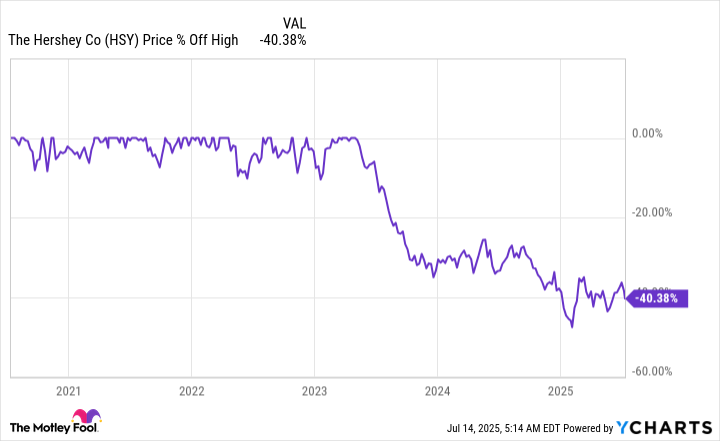

That said, there has been a shocking rise in the price of cocoa, a key input in making chocolate. That will lead to a mid-30% drop in Hershey’s bottom line in 2025. Investors have reacted to that news by dumping the stock, which is down around 40% from its 2023 highs. Hershey isn’t sitting still; it is controlling the things it can control.

Cocoa is a commodity, and Hershey has to take the price volatility in stride. It has been increasing prices, cutting costs, and attempting to improve the efficiency of its business. Eventually, cocoa prices will normalize. Investors, however, are treating the stock as if cocoa prices will forever be inflated. Even in that situation, costs would get passed on to consumers over time. Chocolate is way too popular for people to simply stop eating it. In other words, one way or the other Hershey is likely to return to growth, making now a good time to buy in. A $1,000 investment will net you six shares of the food maker.

Do you follow the pack or are you a contrarian?

It may seem like the stocks making the headlines and rocketing higher right now are the best companies to buy. But far too often those very same stocks, eventually, fizzle out when investors move on to a new favorite story. It pays to carefully examine stocks that are unloved, looking for the ones that have inherently strong businesses with long-term growth opportunities. That’s what Buffett believes he found with Pool Corp. and what throngs of chocolate lovers suggest is the case for Hershey.