A million Brits face being dragged into higher tax rates if Rachel Reeves breaks her vow to end the freeze on thresholds.

Fears are mounting that the Chancellor will opt to extend the long-running stealth raid, as she faces an estimated £30billion hole in the government books.

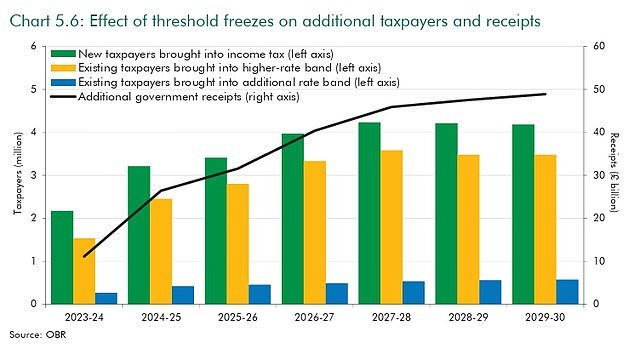

The policy, in place since 2022, is due to end in 2028-29. By that point it will have dragged an extra 4.2million people into the tax system as wages rise.

There will be 3.5million more taxpayers in the higher-rate band, and 600,000 in the top rate.

However, keeping the freeze in place for another two years could bring in an extra £10billion annually for the Treasury according to the IFS think-tank – significantly easing Ms Reeves’ problems.

Around another 400,000 more people would be paying income tax and 600,000 into higher and additional rates by 2029-30.

The Treasury’s OBR watchdog highlighted the impact of the tax threshold freezes in a report this week

Fears are mounting that the Chancellor will opt to extend the long-running stealth raid, as she faces an estimated £30billion hole in the government books

The Treasury’s OBR watchdog has predicted the thresholds freeze will have raised £48.9billion of additional tax by by 2029-30, 1.4 per cent of GDP.

Around 14 per cent of adults will be paying the 40p rate, compared to under 4 per cent in the early 1990s.

IFS director Helen Miller told BBC Radio 4’s Today programme that extending the freeze ‘absolutely would’ be a tax on ‘working people’.

‘The big problem I have with that measure is the lack of transparency,’ she said. ‘It is a big tax rise but not one that people are going to see very easily.’

Extending the freeze would seemingly contradict Ms Reeves’ words at the Budget last year.

She told MPs at the time: ‘Having considered this issue closely, I have come to the conclusion that extending the threshold freeze would hurt working people.

‘It would take more money out of their payslips. I am keeping every single promise on tax that I made in our manifesto.

‘There will be no extension of the freeze in income tax and National Insurance thresholds beyond the decisions by the previous government from 2028-29.’

Ms Reeves has insisted she will not come back for another big raid, but seems to be backed into a corner after guaranteeing to keep the fiscal rules on borrowing.

Keir Starmer dodged on whether the freeze on tax thresholds will be extended as he was grilled by Kemi Badenoch in the Commons yesterday

She has also said Labour will keep the manifesto pledge not to hike taxes on income tax, employee national insurance or VAT.

But experts have suggested that the stalling economy together with spending pressures could mean she has a £31billion funding gap to fill at the Autumn Budget.

Challenged at PMQs yesterday to guarantee that thresholds will not be held again, Keir Starmer merely said: ‘We will stick to our manifesto commitments, we will stick to our fiscal rules.’

A Tory spokesman said: ‘The Prime Minister emphatically ruled out any rises in income tax, NI or VAT.

‘But he wouldn’t repeat the promise his Chancellor made in the autumn to lift the freeze on income tax thresholds.

‘He also refused to rule out a retirement tax and wealth taxes. The only reasonable conclusion is that a toxic cocktail of Labour tax rises are coming in the autumn budget.’

Senior Labour figures have been urging Ms Reeves to impose a new ‘wealth tax’.

Ministers have repeated refused to rule out the idea in recent days, despite the Chancellor previously saying she was ‘not interested’ in it.

But the Treasury watchdog warned yesterday that the government cannot rely on small numbers of ‘mobile’ rich people to fund massive spending demands.

The OBR highlighted the ‘risks’ of trying to milk too much from ‘high net worth’ individuals as it painted a grim picture of the government’s long-term finances.

The tax burden is set to hit a new high as a proportion of GDP after the last Budget imposed a £41billion increase – the biggest on record for a single package.

Advertisement