Now that President Donald Trump’s One Big Beautiful Bill Act has been signed into law, we can get into analyzing what is actually in the legislation.

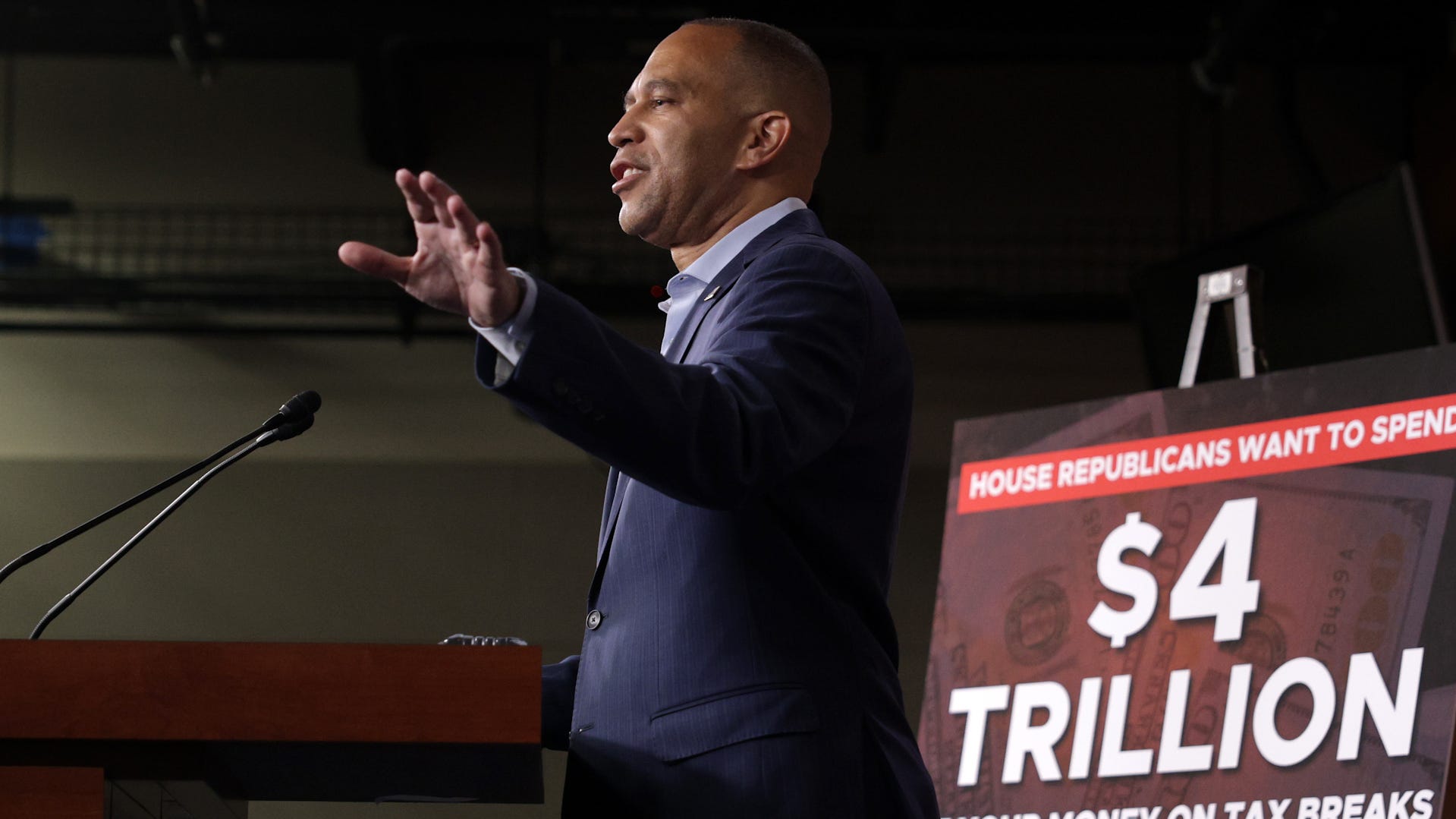

Dems blast GOP Senators for passing ‘Big Beautiful Bill’

Democrats sharply criticized GOP Senators for passing President Donald Trump’s “Big Beautiful Bill.”

Now that President Donald Trump’s One Big Beautiful Bill Act has been signed into law, we can get into analyzing what is actually in the legislation.

There are a few things that are clear to me as a conservative who hoped Republicans would push sound fiscal policies. Primarily, this is a flawed conservative policy.

While it is a good thing that the 2017 Trump tax cuts were extended, there remain a ton of problems with the bill.

Many of the tax break provisions have less to do with economics and more to do with pandering to the American people. Congressional Republicans seemingly made little attempt to justify their poor fiscal ideas, choosing instead to pass Trump’s agenda by any means necessary.

Republicans’ Big Beautiful Bill was about bribing voters

The chief purpose of the bill that is now law was to extend the 2017 Tax Cuts and Jobs Act, which, if allowed to expire, would have resulted in a tax increase for an estimated 62% of Americans. That outcome would be disastrous, both for Americans’ wallets and for future economic growth.

However, the law goes further, creating new tax exemptions for Social Security, tips and overtime pay. These policies, in addition to the poor policy of an increased cap on state and local taxes, are little more than bribes to the American people.

I’m all for new tax cuts, provided we are reducing spending at the same time. But there is no economic rationale for exempting any of these forms of income from taxation. These incomes are not unique in their impact on the economy and should not be treated as such.

The only reason for not taxing tips or overtime in favor of other forms of income is that MAGA lawmakers think they can buy votes. It’s a tactic often employed by congressional Democrats, who promise either student loan forgiveness or taxing the ultrawealthy in order to buy middle-class and youth votes. Conservatives should not be proud of our leaders for stooping so low.

Tax breaks without spending cuts aren’t really tax breaks

Not only are these cuts not coherent in theory, they aren’t even fiscally sound conservative policies.

The issue with this law is that it overlooks the increasingly massive deficit that will be incurred to fund it, as well as the aforementioned new tax breaks.

While it attempts to bridge this gap with good policies, such as work requirements for Medicaid and food stamp benefits, it isn’t enough.

Even after accounting for the economic growth the tax cuts are anticipated to generate, the bill is estimated to add $3.8 trillion to the deficit over the next decade.

Tax cuts paid for through deficit spending aren’t really tax cuts. The cuts still need to be paid for, and both options for doing so would be an additional burden on the American people.

The first option is through borrowing money, which not only further increases the national debt but also increases the revenue required later to repay that debt. Second, this is achieved through printing more money, which is inflationary and places further costs on Americans. There is no magic third way that allows the government to cut taxes and keep spending without, at some point, hurting Americans.

The only way to truly create tax cuts is by commensurately cutting spending at the same time. However, responsible budgets are not the goal of the current GOP. The main goal is to deliver on Trump’s populist attempts to bribe voters, even if, ultimately, this will hurt those voters.

Dace Potas is an opinion columnist for USA TODAY and a graduate of DePaul University with a degree in political science.