If you have $1,000 to invest right now, I’m sure you’re considering many factors when looking for the right stock. Everyone’s checklist will look a little different, with some favoring riskier growth stocks and others looking for stability and value.

Not every growth stock is risky, but the nature of investing implies that in general, younger stocks have more growth potential, and young stocks have some inherent risks. If you can handle a bit of risk and are looking for a top growth stock that’s likely to reward you many times over, Dutch Bros (BROS -2.67%) is an excellent candidate.

Fun and friendly coffee

Dutch Bros has a simple restaurant chain model, but it offers a new spin on coffee. It has its own unique beverages, with a focus on cold drinks, and customers rave about its customized drinks. Since it has developed its expansion plan in recent years, it’s clued into current trends like speed and takeaway, and most of its stores only feature drive-thrus.

As it expands, it’s winning new and loyal customers who appreciate its fun and friendly vibe, and it’s demonstrating strong performance, including profitability at scale.

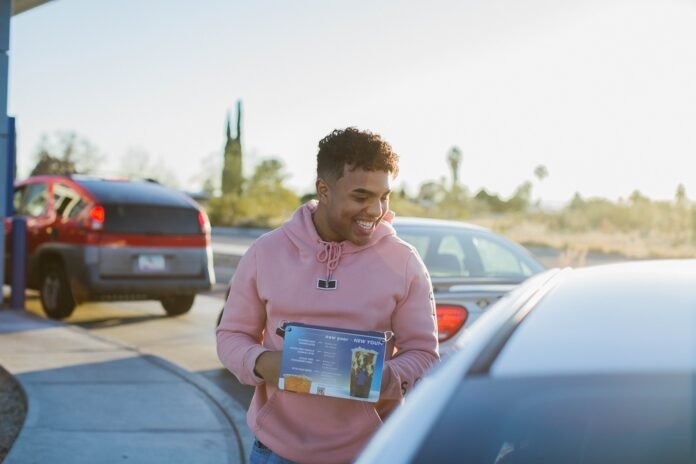

Image source: Dutch Bros.

In the 2025 first quarter, revenue increased 29% year over year, with a 4.7% increase in same-store sales. That included a 1.3% increase in traffic, indicating that people are coming in more frequently and more people are shopping, instead of increases coming just from price increases. Net income increased from $16.2 million in the year-ago quarter to $22.5 million in this year’s Q1.

It recently opened its 1,000th shop, about double the amount it had when it went public four years ago, and it plans to open at least 160 stores this year.

A shop on every corner

Management recently increased its addressable market to 7,000 stores, or seven times today’s store count. It plans on having 2,029 stores by 2029, roughly doubling again in four years. It envisions long-term revenue growth of 20% annually, driven by mid-teens growth from new stores and mid-single-digit comps growth.

The company is making many moves to grow outside of opening new stores. It recently launched mobile ordering, which has shown results. It already accounts for 10% of orders, and it’s driving membership registrations. It also has a strong repeat shopping rate.

Dutch Bros is opening different types of layouts that meet demand in each new location, such as some stores with space to eat in and other stores with walk-up windows. It’s also experimenting with its menu to boost sales. One of its recent actions is bringing more food into stores to boost morning engagement and generate higher beverage sales at that all-important part of the day.

Risk and valuation

All this being said, Dutch Bros is not without risk. Although it’s not really a young company, since it opened its first shop in 1997, it only recently started its domestic expansion strategy and went public in 2021. Investing in it now is having confidence in its ability to reach its store opening and comps growth goals. It’s a long way from small coffee chain to major player.

So far, it’s making decisions that boost my confidence. The founder-CEO stepped aside in 2023 to make way for a seasoned executive to bring the company to the next level. Christine Barone has revamped the C-suite, opened a new operational center, and changed the company’s real estate strategy. These are good moves, but it’s important to note that being in growth mode, it’s still heavily investing and isn’t consistently free-cash-flow positive.

It’s also important for every investor to consider valuation. Dutch Bros stock isn’t cheap by the standard price to earnings (P/E) ratio, which is 160. That’s nosebleed level. On a price-to-sales (P/S) basis, it’s more reasonable, at only 5 times trailing-12-month sales.

If you have some appetite for risk and a long time horizon, consider an investment in Dutch Bros; it should keep up its growth and performance, and could be an incredible addition to a growth-centered portfolio.