A U.S. company has announced a $400 million deal with the United States Department of Defense amid soaring demand for domestically mined rare earth elements that are critical for both civilian and military technologies.

The MP Materials deal is being hailed as a major move toward building out the U.S. mine-to-magnet supply chain and cutting the country’s reliance on geopolitical rival China.

Newsweek reached out to the Pentagon and MP Materials via request for comment outside of office hours.

Why It Matters

China supplies 70 percent of the rare earths imported by the U.S. and controls about 85 percent of the world’s refining capacity—a virtual stranglehold on production of the high-performance magnets used in everything from electric vehicles to missiles.

This dependency is viewed in Washington as an Achilles’ heel. That concern has driven the administration of President Donald Trump to seek out new deals—such as the one signed with Ukraine in May.

What To Know

MP Materials Corp announced Thursday it had entered a public-private partnership with the U.S. Department of Defense that would, in its words, “dramatically accelerate the build-out of an end-to-end U.S. rare earth magnet supply chain and reduce foreign dependency.”

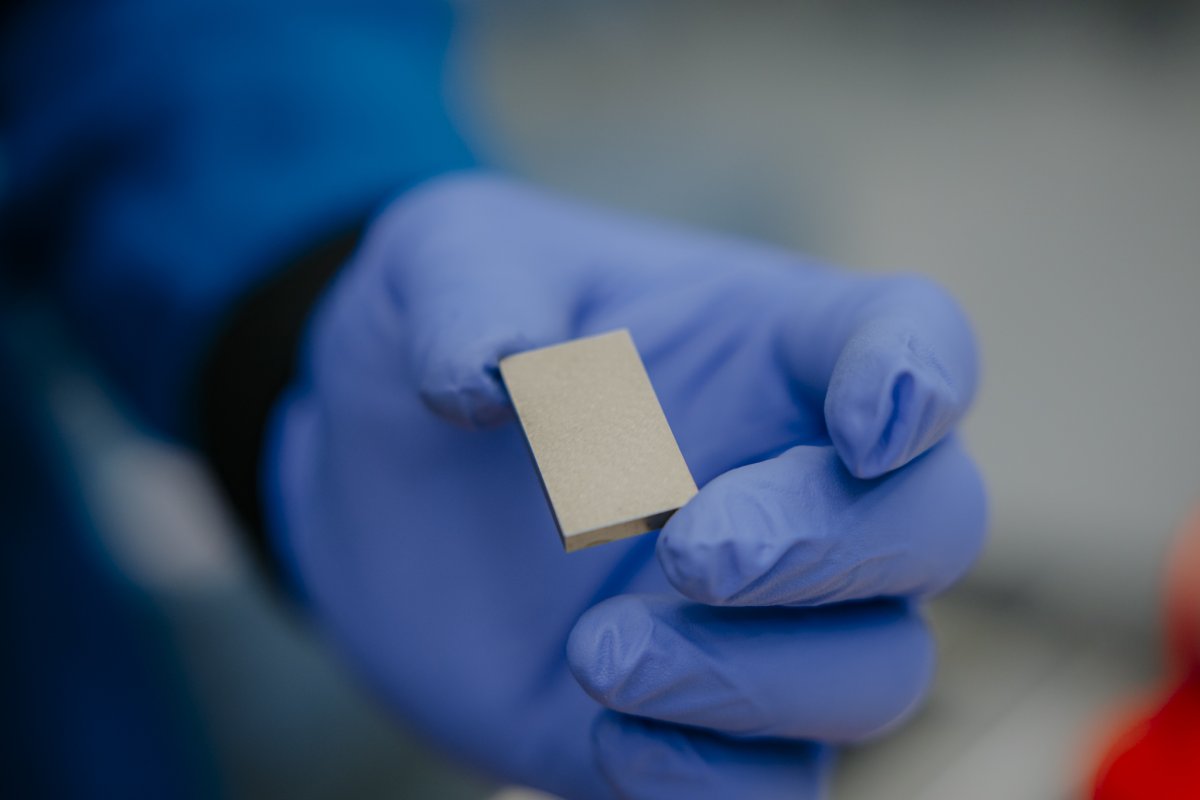

Under the deal, the Pentagon will invest $400 million for a 15 percent ownership stake in the Las Vegas-headquartered firm, whose Mountain Pass mine in California remains the country’s only rare earth mining facility.

The company also processes rare earth concentrate, though most of the final refining and magnet production still takes place in China.

“This initiative marks a decisive action by the Trump administration to accelerate American supply chain independence,” said James Litinsky, Founder, Chairman, and CEO of MP Materials.

MP Materials shares surged by over 50 percent when trading opened Thursday morning.

China has already demonstrated its willingness to leverage its dominance, as in April when it slapped restrictions on several rare earth exports in retaliation for Trump’s tariff hikes on Chinese goods.

Beijing announced last month it was easing those curbs after a 90-day trade truce hammered out with the Trump administration, though U.S. officials complained shipments of the critical resource had not returned to previous levels.

In March, Trump invoked emergency powers under the Defense Production Act to expand domestic production of critical minerals as part of broader efforts to reduce U.S. dependence on China.

What People Have Said

Arnab Datta, Managing Director of Policy Implementation at Employ America and Director of Infrastructure Policy at IFP, wrote on X:

“This is a big deal. It’s many industrial policy financing tools in one transaction: preferred equity purchases, warrants, lending, and a price floor. And a staggering amount of money […]

“A lot of risk to have tied to just one project! It could blow up and the government ends up with little to show for it and a lot of money spent, and the tools delegitimized because of the failure.”

Michael McNair, fund manager at a large U.S.-based asset manager, wrote on X (formerly Twitter): “As I said several months ago, this is how you compete against China to secure domestic supply chains. I expect a lot more of these kinds of deals to come.”

What’s Next

The United States is expected to keep ramping up capacity in this area. In addition to expanding refining at Mountain Pass, MP Materials says it will build a second domestic magnet manufacturing plant.

The “10X Facility” will be funded in part by a committed $1 billion from JPMorgan Chase and Goldman Sachs Bank USA.

Business Wire via Associated Press